Data-driven electronic trading has arrived

Comprehensive marketplace for securitized products: Agency & Non-Agency CMOs, Specified Pools, CMBS, ABS, SBA Pools, CDO/CLOs, (structured) EURO bonds.

Explore our core products

Trading

Analytics

Data

Clients

Trading

Access Unique Liquidity. Easily.

One counterparty agreement to reach 500+ dealers and institutional clients. Facilitate targeted distribution of axes, inventories, bid lists, and two-sided markets. Negotiate directly with the owner of the bond or the end-buyer in real-time.

Liquidity Via Multiple Trading Protocols

Available daily from MBS Source partnerships

- Dealer-to-Customer

- Customer-to-Customer

- Dealer-to-Dealer

Hybrid Electronic-Voice Model

- Experienced facilitation desk

- Expertise and assistance from individuals with extensive bond market experience

- Bridge the gap between voice and electronic trading

Number of Trades

Participation

Volume

Regional Dealers

Bonds

Analytics

Powerful Insights

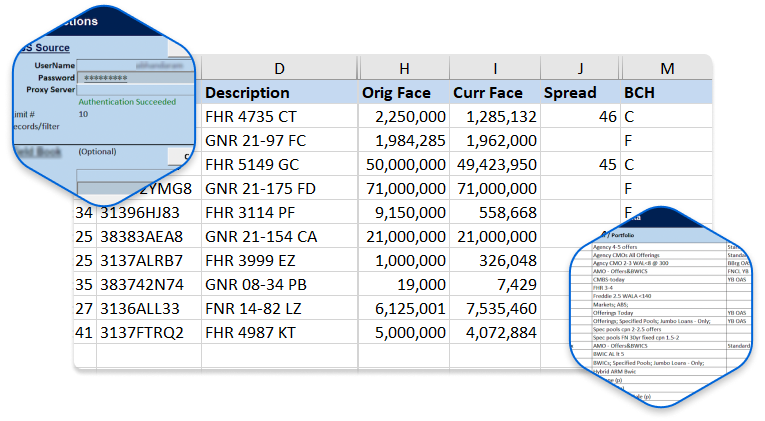

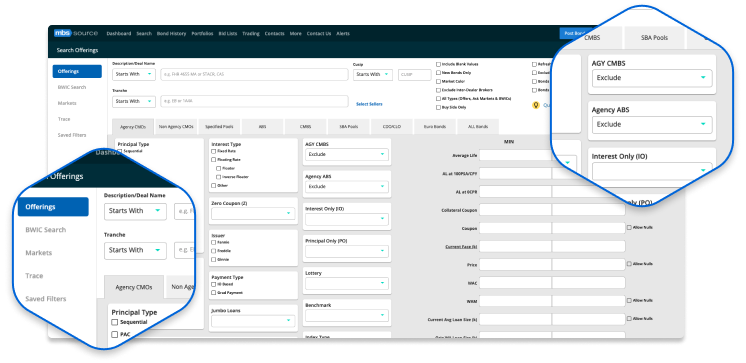

MBSS Excel Workflow Solutions lets you easily download inventories, bid lists, and historical price points from all market participants. You can combine MBS Source data with leading third-party analytics for customized analysis such as relative value, comps for best execution, historical trend analysis, etc.

Choose the analytics tool that

works best for you

- Downloader: import directly into Excel from filters you create on MBS Source

- Template Builder: build custom templates by combining our data with leading third-party analytic platforms

- Customer Reports save your runs and analyze bond performance, run historical trends, relative value analysis and more

- Custom Workflows: automate a sequence of steps for unattended processing. Save snapshots of spreads, OAS etc. for trend analysis at a bond level or niche level (stories, market segments, etc.)

Data

More Informed Decisions When Buying or Selling

Agency & Non-Agency CMOs, Specified Pools, CMBS, ABS, SBA Pools, CDO/CLOs, (structured) EURO bonds. 100 million+ historical price points.

Level the playing field

Every major Wall Street dealer uses MBS Source to explore offerings, BWICs, and two-sided markets.

Spend your time trading, not searching

Get historical information on bonds you are interested in, set up email and platform alerts when those bonds become available. Extensive market pricing data lets you bid with confidence.

Connectivity

Unparalleled Connectivity

We support all industry standards when connecting to our platform and data.